01HighlightsReal option approach is adopted to analyze subsidy for the CCUS project.

Even full investment subsidy cannot stimulate investment immediately.Both electricity tariff subsidy and CO2 utilization subsidy are feasible.Electricity tariff subsidy is higher than the current subsidy for renewable energy.CO2 utilization subsidy is more favorable for developing full-chain CCUS project.02摘要本研究運用實物期權模型,探討了高、中、低煤炭價格水平下,初始投資補貼、電價補貼、CO2利用補貼等不同補貼機制,對中國碳捕集利用與封存(CCUS)項目投資收益的影響。研究結果表明:(1)在當前油價水平下(70美元/桶),美國政府實施的45Q法案對CO2利用補貼(CO2-Enhanced Oil Recovery)的方式是可以應用到中國的,并且能夠即刻激發投資行為。然而,全額初始投資補貼還需要通過其他方式予以輔助,電價補貼需要比目前可再生能源補貼的水平(0.019元/千瓦時)至少提高2.6倍。(2)全額投資補貼和電價補貼下的臨界油價至少需要比現有油價高出2.7%和14.1%。(3)現階段,電價補貼和CO2利用補貼都是可行的,但電價補貼需要超過目前可再生能源的補貼水平;相比之下,CO2利用補貼更有利于推動全產業鏈CCUS項目的發展,并且有助于提高石油產量。(4)在低煤價水平下,當技術學習率達到30%時,最佳投資時機可提前至2023年;在中高煤價水平下,技術學習率未達到5%和10%之前,投資者應放棄投資。本文研究結果能為政府制定CCUS補貼

政策提供參考。A carbon tax is a tax levied on the carbon content of fuels (transport & energy sector) and, like carbon emissions trading, is a form of carbon pricing. The term carbon tax is also used to refer to a carbon dioxide equivalent tax, the latter of which is quite similar but can be placed on any type of greenhouse gas or combination of greenhouse gases, emitted by any economic sector. (from Wikepedia)

03AbstractThis study adopts the real option approach to compare the impacts of different subsidy schemes, including initial investment subsidy, electricity tariff subsidy, and CO2 utilization subsidy, on the investment benefit of carbon capture utilization and storage (CCUS) project in China under high, medium, and low coal price levels, respectively. The results show that: (1) Under the current oil price level (70?USD/bbl), CO2 utilization subsidy referring to the 45Q Tax Credit released by the US government is high enough to trigger the investment behavior immediately. However, the full initial investment subsidy needs to be replenished with other ways and the electricity tariff subsidy needs to increase by 2.6 times compared with the current subsidy for renewable energy (0.019?CNY/kWh). (2) The critical oil prices under full investment subsidy and electricity tariff subsidy need to increase by at least 2.7% and 14.1%, respectively. (3) Both electricity tariff subsidy and CO2 utilization subsidy are feasible, while the former need to exceed the current subsidy for renewable energy and the latter is more favorable in promoting the development of full-chain CCUS project and the increase of oil production. (4) The optimal investment timing can be brought forward to 2023 if the technological learning rate reaches 30% under the low coal price level; the investors should abandon the project until the technological learning rates reach 5% and 10% under the medium and high coal price levels, respectively. Overall, our results enable to provide useful information for the policy-makers to formulate subsidy policies.

Keywords:CCUSInitial investment subsidyElectricity tariff subsidyCO2 utilization subsidyReal option

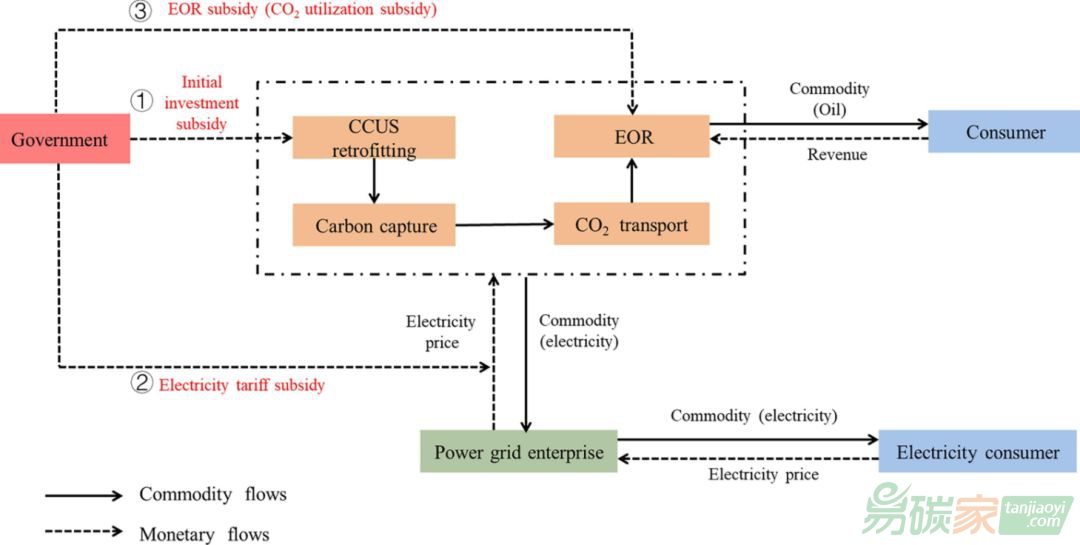

Fig. 1. The vertically integrated business model and corresponding government subsidies for CCUS project.